This spring, William and Sarah Flores purchased their first home in Sublette, Kansas, a rural town of about 3,500 people. This was familiar territory; Sarah is no stranger to small towns, and the spacious 1970s home, surrounded by fields and lush flowers, has a rich history—it all once belonged to Sarah’s grandmother.

William, Sarah, and their three children moved into their Sublette home 10 years ago from their self-described “little cracker jack box” duplex with high utility bills in Liberal. They first arrived as house sitters during the grandmother’s hospital stay, and they remained there as tenants during her transition to a nursing home. “I want you to have my house,” Sarah’s grandmother said. When her grandmother passed, the Flores family decided to purchase the home. They closed on April 1, 2024, with the help of down payment and closing cost assistance from the First Time Homebuyer program, administered by Kansas Housing Resources Corporation (KHRC).

William, Sarah, and their three children moved into their Sublette home 10 years ago from their self-described “little cracker jack box” duplex with high utility bills in Liberal. They first arrived as house sitters during the grandmother’s hospital stay, and they remained there as tenants during her transition to a nursing home. “I want you to have my house,” Sarah’s grandmother said. When her grandmother passed, the Flores family decided to purchase the home. They closed on April 1, 2024, with the help of down payment and closing cost assistance from the First Time Homebuyer program, administered by Kansas Housing Resources Corporation (KHRC).

The Flores’ first became aware of the program 11 years ago and took a class on homeownership. While they met income qualifications to receive First Time Homebuyer assistance, they realized they needed to increase their credit scores and savings. They took the necessary steps to save more money and improve their credit, which paid off by the time they were ready to purchase their home. Meanwhile, a realtor friend, Janie Welsh, pointed them toward USDA Rural Development to see which homebuying assistance program would fit them best. William then reached out to First Time Homebuyer program manager, Marilyn Stanley. He was pleased to discover that the program’s down payment and closing cost assistance, loaned in the form of a soft second mortgage, would be forgiven if the family remained in the home for ten years. Welsh assisted them with applying for the First Time Homebuyer assistance, and the family was approved.

The Flores’ first became aware of the program 11 years ago and took a class on homeownership. While they met income qualifications to receive First Time Homebuyer assistance, they realized they needed to increase their credit scores and savings. They took the necessary steps to save more money and improve their credit, which paid off by the time they were ready to purchase their home. Meanwhile, a realtor friend, Janie Welsh, pointed them toward USDA Rural Development to see which homebuying assistance program would fit them best. William then reached out to First Time Homebuyer program manager, Marilyn Stanley. He was pleased to discover that the program’s down payment and closing cost assistance, loaned in the form of a soft second mortgage, would be forgiven if the family remained in the home for ten years. Welsh assisted them with applying for the First Time Homebuyer assistance, and the family was approved.

“I always wanted a bit of earth, like the little girl asks for in The Secret Garden, but every time I tried to get my own bit of earth, something in life happened, and it just went poof! Now that I have my bit of earth, I take a sigh of relief.”

The first night they moved in, a local cat, Silky, adopted the Flores family as their first guest while the family returned Liberal to pack up the rest of their home. The rest of the family moved in the next night, followed by a string of other pets that found them over the years: Coco found them at the library, they adopted Goober a year later, and they inherited their dog Lola from a friend that moved away.

After closing on their home. Sarah says, “A weight lifted off our shoulders. For the first time in seven years, we felt secure.” For Sarah, that security came from the solid ground the family could call their own: “I always wanted a bit of earth, like the little girl asks for in The Secret Garden, but every time I tried to get my own bit of earth, something in life happened, and it just went poof! Now that I have my bit of earth, I take a sigh of relief,” she says. It seems Sarah has found her secret garden in spades in the legacy her grandmother left: there’s lemon balm to keep the mosquitoes away, countless blood-red rose bushes that bloom each year, a 20-year-old lilac tree towers as tall as the house, Creeping Charlie to greet guests at the door, and the white, yellow, and red blossoms of Joseph’s Coat bloom as big as your hand.

Of course, the Flores’ transition into rural homeownership did not come without its jolting discoveries. Home improvement started right away when Sarah shut off the breaker to the house, which ignited sparks and quickly elicited a neighbor’s help to fix the underlying issues. While unloading moving boxes from the car to the house, Sarah recalls her daughter running into the garage screaming, “Mommy, help! It’s a moving rock!” When Sarah inspected the front yard, she discovered the moving rock was her daughter’s first turtle sighting! They quickly discovered the dilapidated backyard shed had been taken over by a snake, a first of many repairs that realtor Janie Welsh helped fix to keep the snakes away. Welsh also completely renovated the children’s bathroom, painted the hallway, and replaced floors in the kitchen, dining room, laundry room and master bathroom.

After the initial culture shocks had subsided and the repairs had been made, the family settled in with gratitude for their new space. “We went from having no yard to lots of yard. We could probably fit our entire duplex in the dining room here,” says Sarah. The children also enjoy more personal space than they had in their Liberal home, where the two boys shared a room and the parents shared a corner of the living room to provide a separate bedroom for their daughter. The family also has lower utility bills now, thanks in part to qualifying for free weatherization upgrades, funded by KHRC’s Weatherization Assistance Program. “The home has brand new windows; it’s more insulated and sealed, which is great because we’re allergic to everything; and we can keep the thermostat at about 76 to 77 degrees year-round,” said Sarah and William.

While their three special needs children experienced daily challenges transitioning to life in Sublette over the past ten years, they all have well-established friend groups now, and benefit from smaller class sizes in school. Their oldest son recently from graduated high school. Sarah says her anxiety has been reduced by living in Sublette because the townspeople look out for each other, and she’s comfortable with her children riding bikes and playing until the streetlights come on.

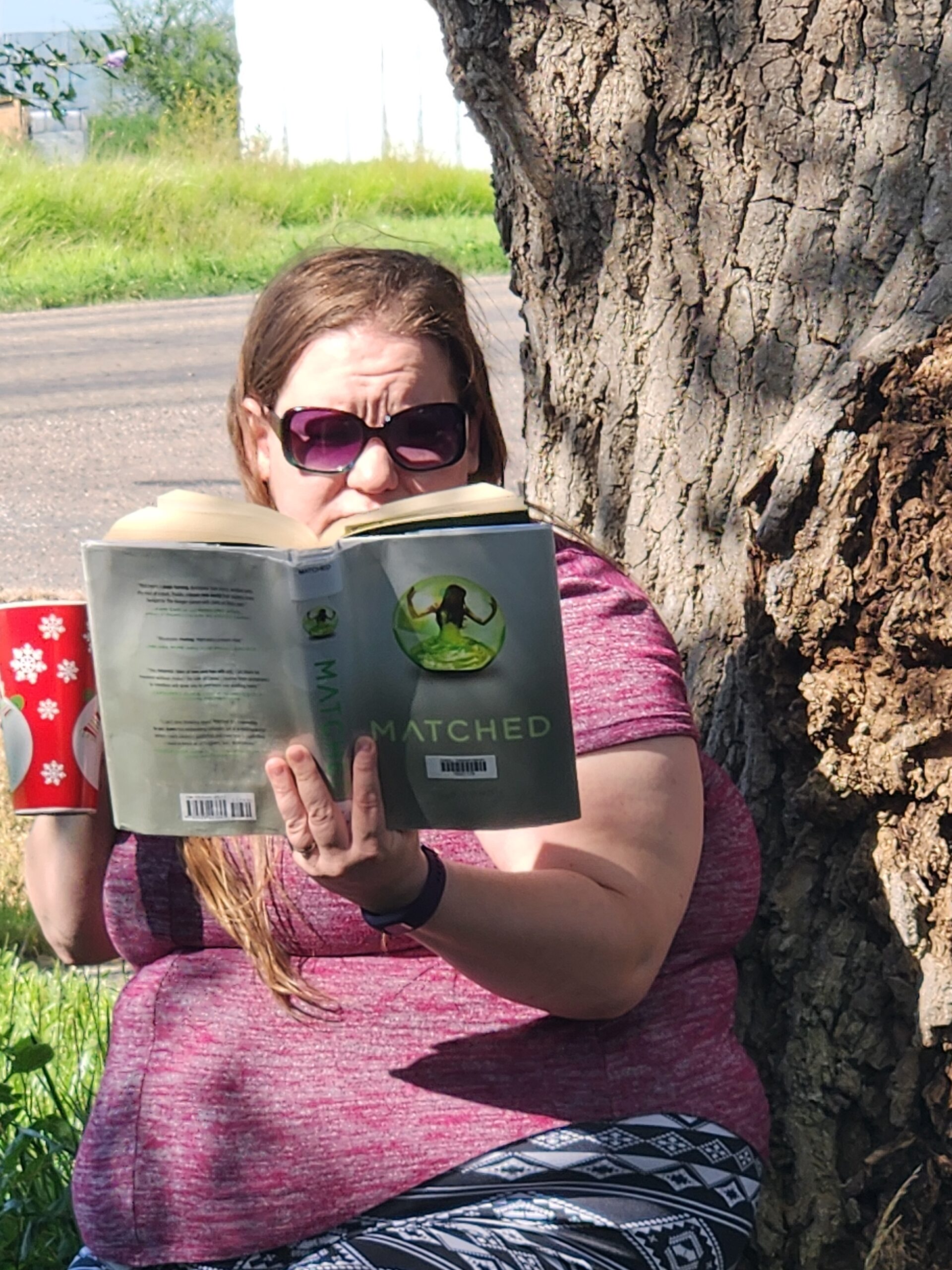

For the Flores family, less has become more. “It’s so much more serene; I like going outside and hearing nothing. We’ve got a big Cottonwood tree where I like to sip my coffee, read a book, and not have to worry about anybody bothering me,” says Sarah. “We miss some things, some restaurants, compared to Liberal,” admits William. But Sarah acknowledges “Since we moved here, we have lost weight; I’ve gone down four sizes. I don’t have access to fast food anymore.”

For the Flores family, less has become more. “It’s so much more serene; I like going outside and hearing nothing. We’ve got a big Cottonwood tree where I like to sip my coffee, read a book, and not have to worry about anybody bothering me,” says Sarah. “We miss some things, some restaurants, compared to Liberal,” admits William. But Sarah acknowledges “Since we moved here, we have lost weight; I’ve gone down four sizes. I don’t have access to fast food anymore.”

The family agrees that feeling a sense of community and belonging is the best part of owning their home. Sarah explains, “We’re all neurodivergent, so we’re used to feeling like we don’t belong, but here we’ve found our village.”

Are you interested in purchasing your first home, but don’t know where to begin? We invite Start Your Homebuying Journey or to reach out to one of our participating lenders, all of which serve the entire state of Kansas.

###

Administered by Kansas Housing Resources Corporation (KHRC), the state’s First Time Homebuyer program helps income-eligible households purchase their first home by providing down payment and closing cost assistance. Program updates have expanded eligibility. Homes in Kansas City, Topeka, Lawrence, Wichita, and Johnson County are not eligible for program assistance. KHRC’s Home Loan Guarantee for Rural Kansas program helps rural homebuyers secure the gap between the cost of constructing or rehabilitating a home and its appraised value.

Kansas Housing Resources Corporation (KHRC) is a self-supporting, nonprofit, public corporation committed to helping Kansans access the safe, affordable housing they need and the dignity they deserve. KHRC serves as the state’s housing finance agency, administering essential housing and community programs to serve Kansans.