Home Loan Guarantee for Rural Kansas

- Home

- Homeowners

- Home Loan Guarantee for Rural Kansas

Case Study

Coming Soon

Program Description

The Home Loan Guarantee for Rural Kansas (HLG) helps financial institutions guarantee the gap under a loan used for land and building purchases, renovation, and new construction costs that may be capitalized or financed within rural Kansas counties. HLG will guarantee the amount of the loan that exceeds 80% of the appraised value of the home, up to 125% of the appraised value of the home subject to the loan. Each amount of guarantee shall not exceed $100,000.

Kansans Served

The Home Loan Guarantee for Rural Kansas serves financial institutions that serve existing and prospective homeowners in rural Kansas counties. Eligible financial institutions include banks, trust companies, savings banks, credit unions, savings and loan associations, or any other lending institution.

Funding Source

$2 Million in Non-Recourse Guaranty through the Kansas Rural Home Loan Guarantee Act. The amount of each guarantee shall not exceed $100,000.

Staff Contact

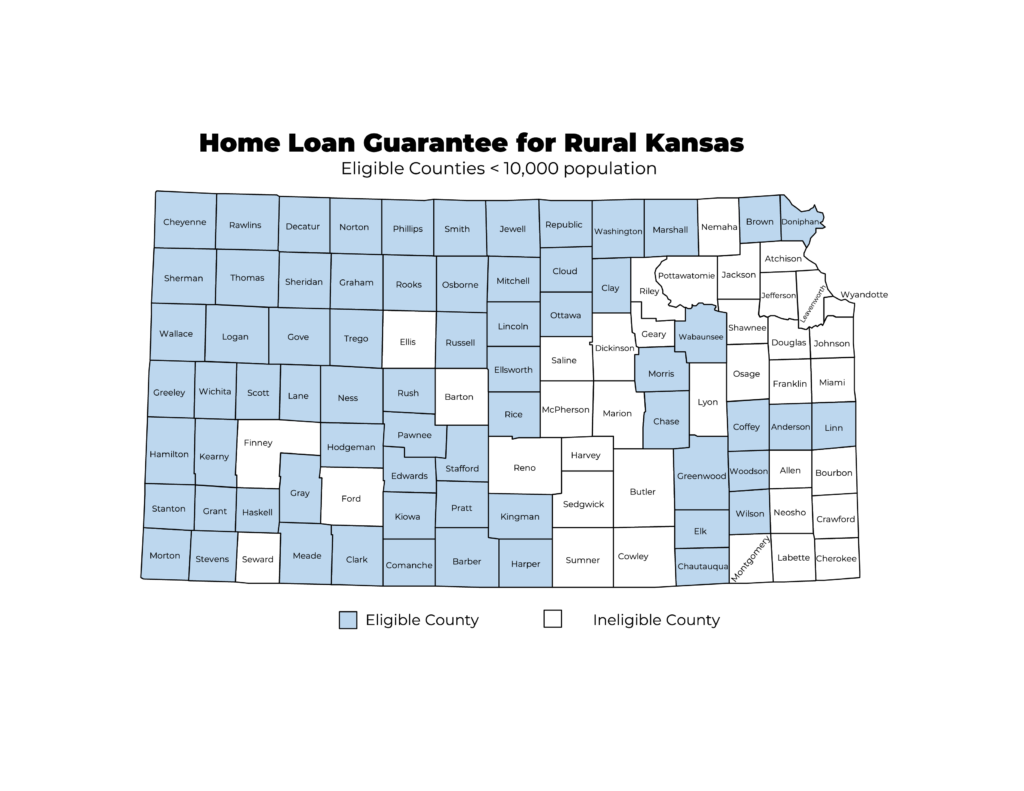

Rural counties are defined as those with populations under 10,000, as certified by the Secretary of State on July 1 of the preceding year.

Example - $200,000 Appraisal

HLG provides from 80% of the appraised value up to the loan amount or 125% of the appraised value, whichever is less, subject to an overall limit of $100,000.

- If the loan amount is $225,000, the guaranty is $65,000 (80% of the appraisal up to the loan amount because the loan amount is less than 125% of the appraisal)

- If the loan amount is $250,000, the guaranty is $90,000 (80% of the appraised value up to the loan amount because the loan amount is equal to 125% of the appraisal)

How To Apply

Seeking assistance covering your home’s appraisal gap? Find a lender serving your area here.

Want to partner with us as a participating lender?

Prospective lenders must first complete the lender enrollment form. Once approved, KHRC and the lender will jointly complete an MOU. The lender may then submit each new loan to KHRC along with a completed loan enrollment application.

The following entities are eligible to participate as lenders: banks, trust companies, savings banks, credit unions, savings and loan associations, or any other lending institution located in Kansas. All must have an active NMLS and provide mortgage loans.

Upcoming Listening Sessions

The HLG program opened January 3, 2023. View the HLG Fact Sheet here.

Questions? Email our Home Loan Guarantee team at HomeLoanGuarantee@kshousingcorp.org

Documents | Forms | Resources

- Overview of the Home Loan Guarantee for Rural Kansas Program

- HLG Request for Reservation of Loan Guarantee Funds for Financial Institutions

- Homebuyer Release of Information Form

- HLG Fact Sheet

- HLG Loan Guaranty Agreement – DRAFT 11-16-22

- Home Loan Guarantee for Rural Kansas Map

- Kansas Counties with Population

- HB 2237 Enrolled into Law Effective July 1, 2022

- Home Loan Guarantee for Rural Kansas – Listening Session for Public Comment

HLG IN THE NEWS

Kansas Housing Association Housing Highlights Newsletter – KHA – Jan. 20, 2023

New program hopes to grow homeownership in rural Kansas – KSN – Jan. 3, 2023

New program hopes to grow homeownership in rural Kansas – MSN – Jan. 3, 2023

$2 million available to help construction of new homes in rural Kansas – WIBW – Jan. 3, 2023

HLG in the News

Kansas Housing Association Housing Highlights Newsletter – KHA – Jan. 20, 2023

New program hopes to grow homeownership in rural Kansas – KSN – Jan. 3, 2023

New program hopes to grow homeownership in rural Kansas – MSN – Jan. 3, 2023

$2 million available to help construction of new homes in rural Kansas – WIBW – Jan. 3, 2023