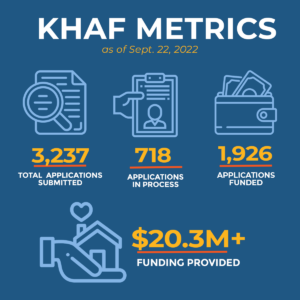

The Kansas Homeowner Assistance Fund (KHAF) has granted 1,926 homeowner applications a total of $20,325,452 in mortgage, property tax and utility aid to date. Yet thousands of Kansans are still in danger of losing their homes.

In its most recent report, the Mortgage Bankers Association said that in Kansas, 10,098 mortgages were past due, with 5,353 seriously delinquent. Only 1,926 applications have been granted, which means there is a significant gap in the number of people who need help and the number who have received assistance. This is a prime opportunity for lenders to help struggling homeowners maintain stable housing, while also preserving their asset quality.

“So many people are still feeling the financial repercussions of the pandemic,” says Marilyn Stanley, KHAF Program Manager at Kansas Housing Resources Corporation, the organization responsible for administering KHAF funds. “These are homeowners who never thought they’d need this type of help, and many of them don’t know about KHAF yet.”

The purpose of the KHAF program, funded by the American Rescue Plan Act, is to prevent foreclosures on homeowners suffering pandemic-related financial hardship. Kansas Housing is urging lenders to do three things:

- register for the program as a participating lender,

- proactively educate their customers about KHAF and

- send them to the online application on the KHAF webpage and help them apply, if needed.

Since all payments go directly to the delinquent account, not the homeowner, it’s vital for banks, credit unions and other loan servicers to get registered. To date, more than 193 servicers are registered with KHAF.

Most important, Stanley encourages banks, credit unions and other mortgage lenders to talk to customers who may benefit from this program. With fears of fraud and financial scams, KHAF may sound too good to be true. The homeowner will be more receptive to the lender, a trusted source of financial information.

Homeowners must be low- to moderate-income, and can see if they qualify by answering a few questions in the homeowner application portal on the Kansas Housing website.

“Financial instability and the fear of losing your home is traumatic. Talk to customers that you think may benefit,” says Stanley, “this is a win-win for homeowners and lenders.”

About KHAF

The KHAF program is funded by the American Rescue Plan Act and administered by the Kansas Housing Resources Corporation. More information for lenders is available on our website.

KHAF Call Center

To assist both homeowners and lenders.

8 am – 5 pm CST, Mon–Fri

855-307-KHAF (5423)

This project is being supported, in whole or in part, by federal award number HAFP-0140 awarded to Kansas Housing Resources Corporation by the US Department of the Treasury.

###

Kansas Housing Resources Corporation (KHRC) is a self-supporting, nonprofit, public corporation committed to helping Kansans access the safe, affordable housing they need and the dignity they deserve. KHRC serves as the state’s housing finance agency, administering essential housing and community programs to serve Kansans.